ny paid family leave tax category

Part-time employees may be eligible for Paid Family Leave. New York paid family leave benefits are taxable contributions must be made on after-tax basis.

They are however reportable as income for IRS and NYS tax purposes.

. Fully Funded by Employees. What Is Ny Paid Family Leave Tax. Employees can request voluntary tax withholding.

Paid Family Leave benefits are not subject to employee or employer FICA FUTA or SUTA. Be that employees employers or insurance carriers the NYPFL category raises some questions for many. The New York State Department of Taxation and Finance DOTF issued much-needed guidance regarding the tax treatment of deductions from employee wages used to finance paid family leave premiums and the tax treatment of paid family leave benefits to be received by eligible employees.

W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program has tax implications for New York employees employers and insurance carriers including self-insured employers employer. Part-time employees who work a regular schedule of less than 20 hours per week for a covered employer are eligible to take Paid Family Leave after working 175 days for their employer which do not need to be consecutive unless they qualify for and have executed a waiver. Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

The maximum annual contribution is 38534. Pursuant to the Department of Tax Notice No. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836.

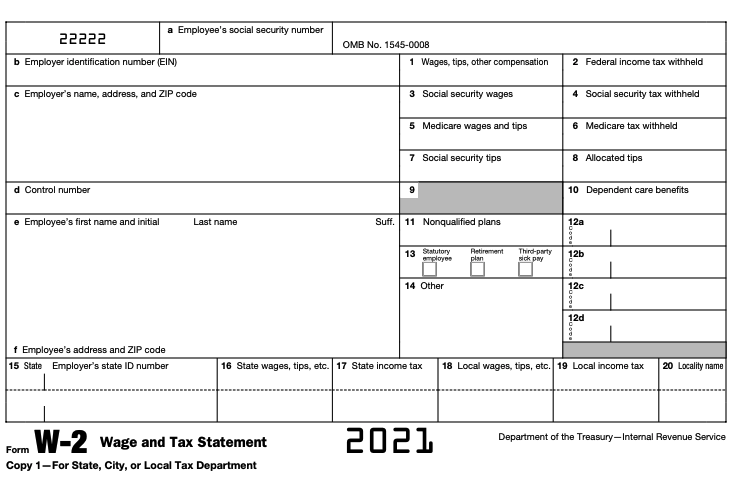

In 2021 the contribution is 0511 of an employees gross wages each pay period. It was recently made part of the W-2 form in 2018 and the employer is required to fill it just as other boxes on. This is 9675 more than the maximum weekly benefit for 2021.

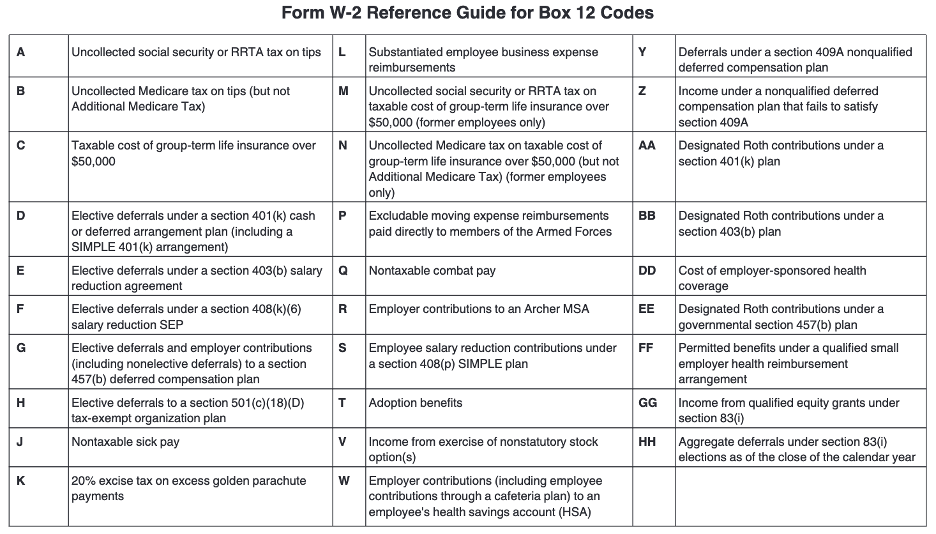

Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation. Set the appropriate NY rates for Family Leave Rate and Family Leave Wage Base. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

Employees earning less than the Statewide Average Weekly Wage SAWW. Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax. Paid Family Leave Benefits available to employees as of January 1.

If an employer chooses to hire a temporary employee to replace a regular employee while they are on Paid Family Leave could. New York Paid Family Leave is insurance that may be funded by employees through payroll deductions. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Understanding NYPFL Category On Your W-2 Tax. In 2016 New York enacted the nations strongest and most comprehensive Paid Family Leave policy so working families would not have to choose between caring for their loved ones and risking their economic security. After discussions with the Internal Revenue Service and its review of other legal sources the New York Department of Taxation and Finance issued guidance regarding the tax implications of its new paid family leave program.

In November 2021 Governor Kathy Hochul signed legislation to further strengthen Paid Family Leave by expanding family care to. You may request voluntary tax. Nlu4v68qdnluwm Paid Family Leave benefits received by an employee are not considered remuneration for UI reporting purposes and are not subject to contributions.

Your PFL benefits are taxable. The maximum 2021 annual contribution will be 38534 up from 19672 for 2020. State disability needs to be reported separately from the Paid Family Leave in box 14 of Form W-2.

Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020. Set up the NY. Employee-paid premiums should be deducted post-tax not pre-tax.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. NYPFL or New York Paid Family Leave has caused some confusion regarding tax for New Yorkers. For 2022 the deduction will be 0511 of a covered employees weekly wage capped at 815 per week 42371 per year.

N-17-12 PDF Paid Family Leave contributions are deducted from employees after-tax wages. The paid family leave can be called Family Leave SDI as long as it is a separate item in box 14. Confirm the clients state is NY.

Yes NY PFL benefits are considered taxable non-wage income subject to federal income tax March 15 2020 520 PM. The maximum annual contribution is 42371. New York State intends Paid Family Leave to be funded entirely by payroll deductions from covered employees.

Yes New York will tax your Paid Family Leave Income however employment tax FICA is not charged. At 67 of Pay Up to a Cap Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW. This deduction will appear on paychecks with the description NY FLIEE.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period.

Readers Choice Awards 2021 By Times Colonist Issuu

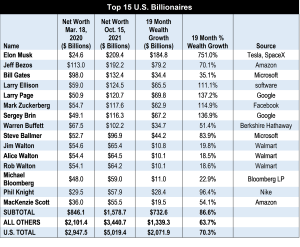

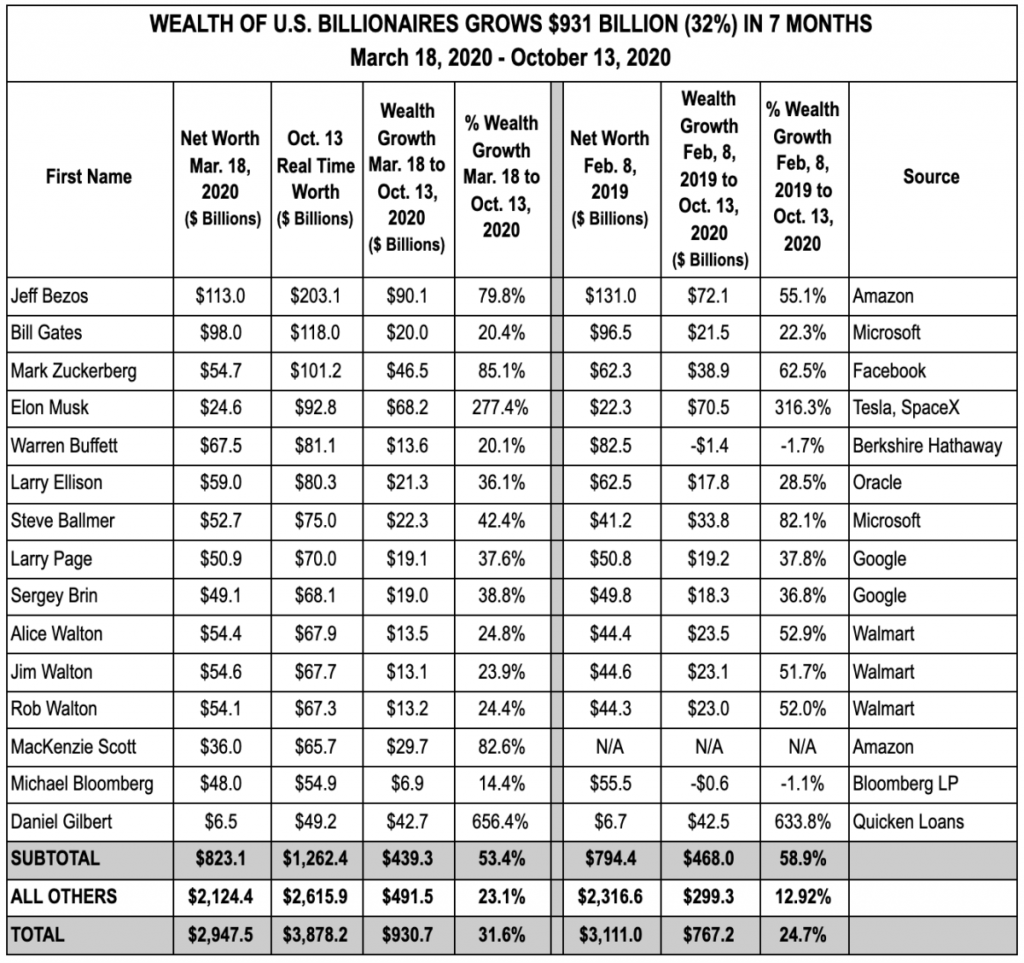

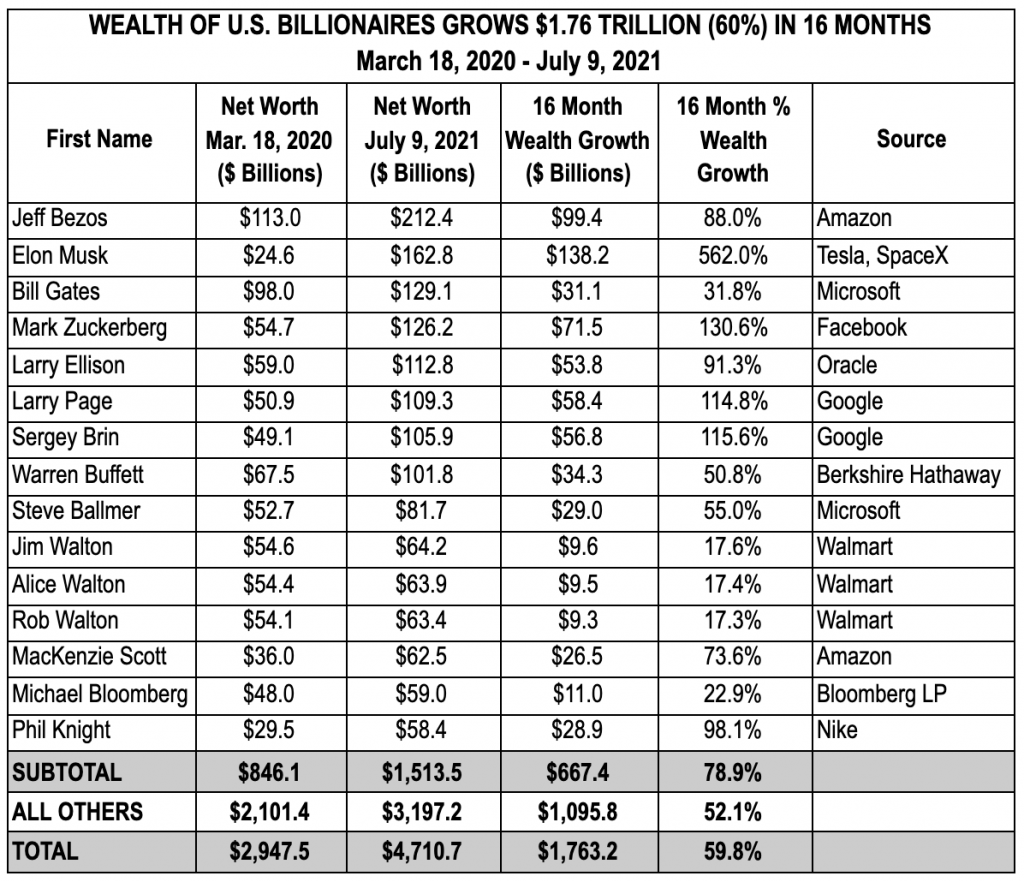

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

The Real Lesson For All Factions Of The Democratic Party The American Prospect

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

To Protect Frontline Workers During And After Covid 19 We Must Define Who They Are

Updates Billionaire Wealth U S Job Losses And Pandemic Profiteers Inequality Org

New York Paid Family Leave Updates For 2022 Paid Family Leave

How Science And Genetics Are Reshaping The Race Debate Of The 21st Century Science In The News

How To Read Your W 2 Justworks Help Center

/hedgefund-2be53ee72e554f87b23ec69d30d426e4.png)